oregon workers benefit fund tax rate

The purpose of the tax is to help fund programs in Oregon to help injured workers and their families. This tax rate is the same for all.

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

The WBF is healthy made so by a growing economy which positively affects the assessment because its based on hours worked.

. If the Oregon Worker Benefit Fund OR WBF tax rate is changing in January any year. 33 cents per hour. The second part determines how an employer is assigned a tax rate within a schedule.

Employers contribute half of the hourly assessment and deduct half of the assessment from. Common questions answered regarding WBF Assessment 503-378-2372 wbfa ssessmentsdcbsoregongov. The assessment is paid directly to Oregons Employment and Revenue departments through quarterly payroll tax reports and the revenue is transferred to DCBS.

WBF Assessment Rate Employers Portion Workers Portion. Oregon has only a small percentage of employers that pay that much and Oregon employers never pay more than 54. OregongovdcbscostPagesindexaspx for current rate notice.

For 2019 our analysts recommend lowering the assessment from 28 cents per hour worked in 2018. 165 cents per hour. When determining the 2021 tax rates we use the period July 1 2017 to June 30 2020.

Your tax rates may fluctuate during the 2022 2024 period due to tax schedule changes. Employers and employees split this assessment which employers collect through payroll. 165 cents per hour.

14 cents per hour. Go online at httpswww. For Agency information please see Oregon Workers Compensation Division website.

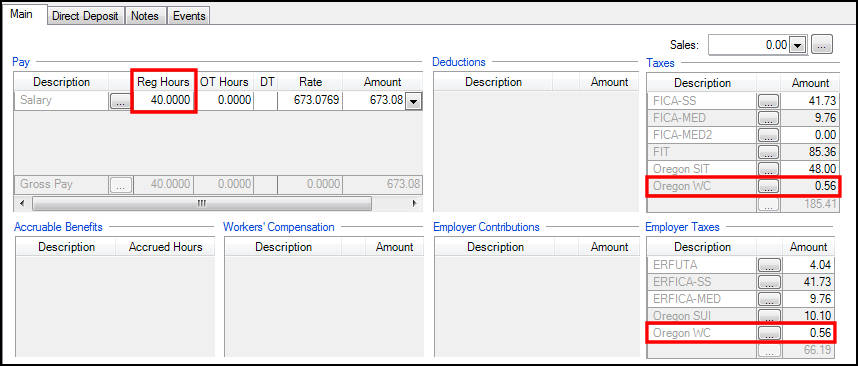

33 cents per hour. You are responsible for any necessary changes to this rate. Tax Formula Set Up.

For example The 2017-2018 rate is 28 cents for each hour or partial hour and the 2019 rate is 24 cents The xxx cents includes the employer rate and worker rate combined. This booklet addresses only the WBF assessment and does not cover information provided in the annual Oregon Combined Payroll Tax Reporting Instructions located at httpswwworegongovdor. Employers can deduct 11 cents per hour from employees if they choose to have employees pay a portion of the 22 cents per hour employer tax.

However the rate will be based on your experience rate prior to the pandemic. The workers benefit fund assessment rate is to be 22 cents per hour in 2022 Employers are required to pay at least 11 cents per hour The Oregon workers compensation payroll assessment rate is not to change in 2022 the state Department of Consumer and Business Services said Sept. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment.

165 cents per hour. Line 10 of the formula can be set up one of two ways depending on how your company decides to handle the tax calculation for salaried Employees. No change remains at 22 cents per hour worked in 2022.

Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. Workers Benefit Fund - Oregon best wwworegongov. 14 cents per hour.

Departments through quarterly payroll tax reports and the revenue is transferred to DCBS. The Oregon Employment Department mails notifications to businesses regarding their individual tax rates and encourages employers to wait until they receive their individual notice before attempting to. 28 cents per hour.

28 cents per hour. Workers Benefit Fund assessment. Gives benefits to families of workers who die from workplace injuries or diseases.

In 2021 this assessment is 22 cents per hour worked. Individual employer tax rates depend on their experience rating or benefit ratio which essentially measures the rate at which their employees have received UI benefits. Employers and employees split the cost.

Employers and employees split this assessment which employers collect through payroll. The Workers Benefit Fund The WBF assessments collected from employers and workers are deposited into the Workers Benefit Fund. 1 2021 this assessment will see no change remaining at 22 cents per hour or partial hour worked by each person that an employer must cover or.

165 cents per hour. In 40 other states employers can pay more than 54 with one state having a maximum rate of 1855. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to families of workers who die from workplace injuries or diseases.

Provides increased benefits over time for workers who are permanently and totally disabled. If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under workers comp. For 2020 our analysts recommend lowering the assessment from 24 cents per hour worked in 2019 to 22 cents per hour worked in 2020.

Employers and employees split the cost evenly 11 cent per hour worked. The 22 cents-per-hour rate is the employer and worker rate combined. The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked.

This fund supports programs that directly benefit injured workers and the employers who help them return to the work force. For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessmen t is 22 cents per hour worked in 2022 unchanged from 2021.

For 2022 the Oregon Workers Benefit fund rate remains at 22 cents per hour worked in 2022. ResourceWorkers compensation rate information. The employee contribution is handled via tax code ORWCW and the employer contribution is handled via tax code ORWCW.

Questions regarding your subjectivity to WBF assessment or workers compensation law 503-947-7815 workcompquestionsdcbsoregongov. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee. The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

Workers Benefit Fund Assessment Rate Andrew Stolfi September 16 2021 The Workers Benefit Fund WBF assessment provides benefit increases to permanently disabled workers and to families of workers who died from a workplace injury or. 14 cents per hour. More information about pro-grams supported by the Workers Benefit Fund is at.

1 2022 this assessment will see no change remaining at 22 cents per hour or partial hour worked by each person an employer must cover or chooses. Federal law requires all states to have at least some employers pay at least 54 in UI taxes each year. Additionally an employers UI tax experience rating for 2022 through 2024 will roll back to the pre-pandemic 2020 UI experience rate benefit ratio.

14 cents per hour.

Top 5 Workers Compensation Claims And Their Causes

Workers Compensation Overview And Issues Everycrsreport Com

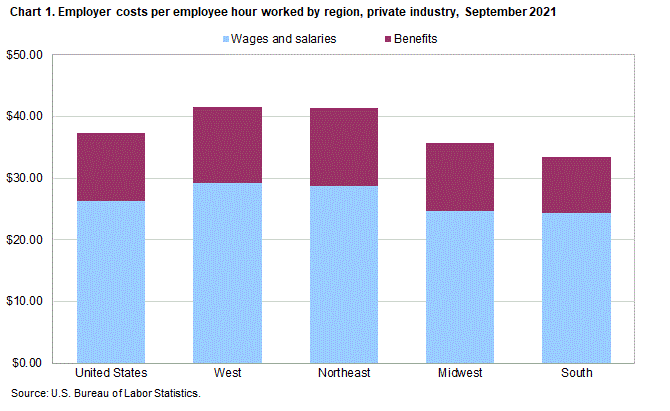

Employer Costs For Employee Compensation For The Regions September 2021 Southwest Information Office U S Bureau Of Labor Statistics

What Wages Are Subject To Workers Comp Hourly Inc

Employee Age And Workers Compensation Utilization Amtrust Financial

Workers Compensation Insurance Commission

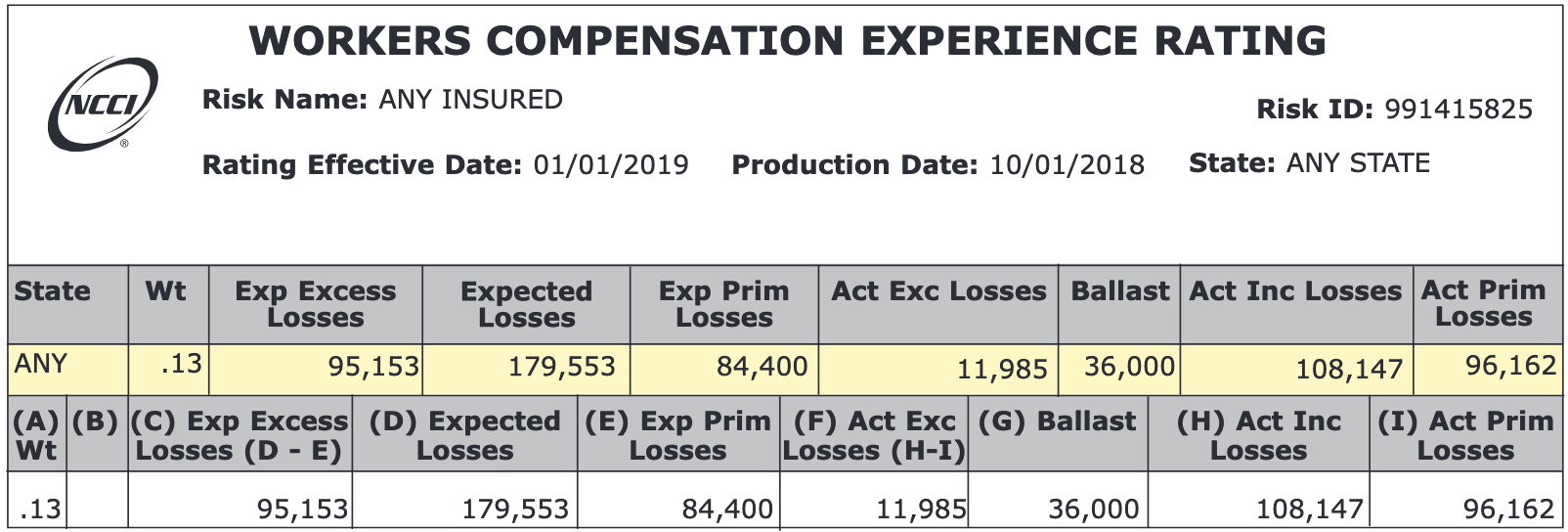

Understanding Your Workers Comp Ex Mod Factor Payroll Medics Payroll Workers Compensation Hr Solutions

Is Workers Comp Taxable Workers Comp Taxes

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

Terminating An Employee On Workers Compensation Nsw Owen Hodge Lawyers

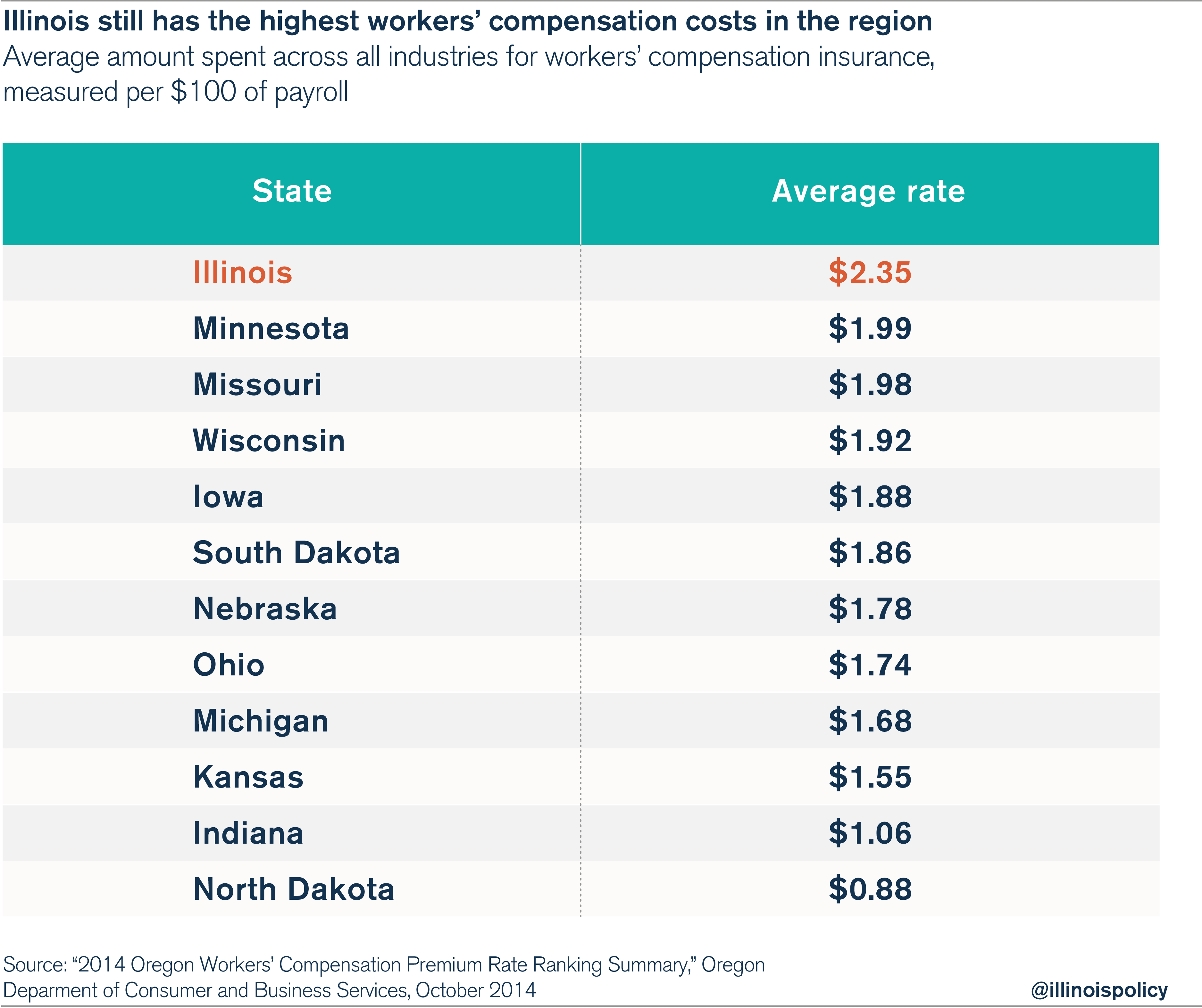

Illinois Still Has The Highest Workers Compensation Costs In The Region By Far

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

Payroll Reporting With Paypro Policyholder Center

Workers Compensation Attorneys In York Pa Free Confidential Consultation

Oregon Workers Compensation Division Order Compliance Poster Employer State Of Oregon

What To Do When You Re Offered A Workers Comp Settlement Top Legal Advice